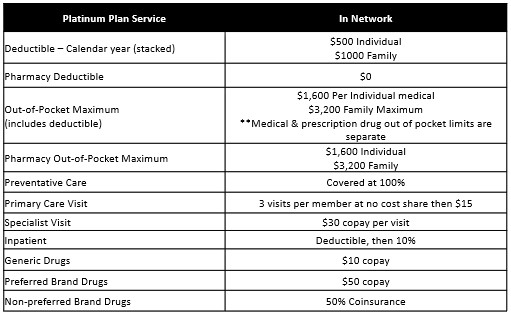

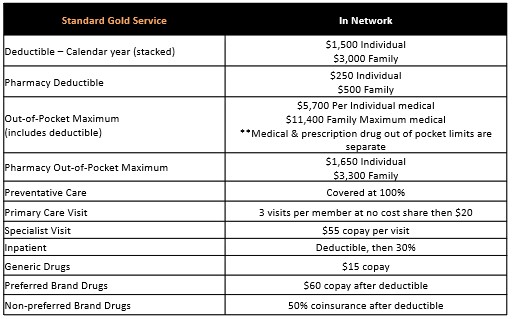

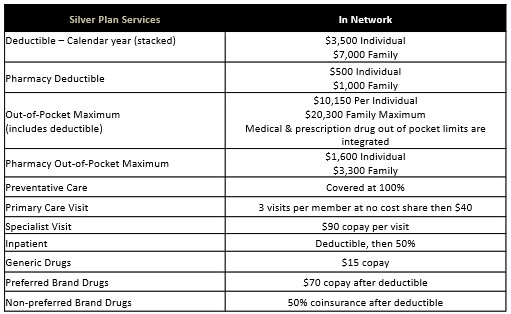

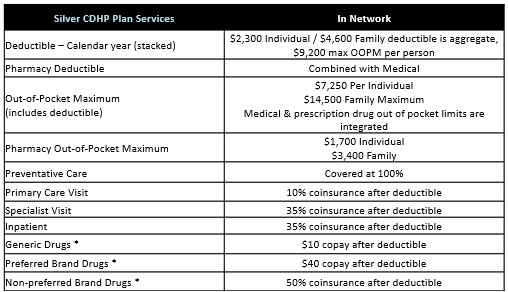

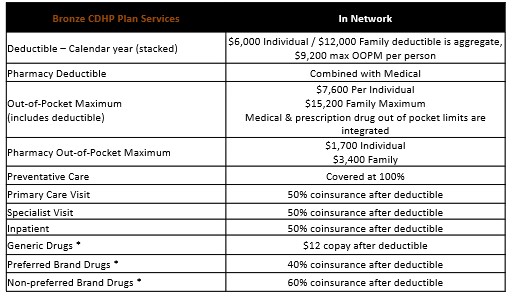

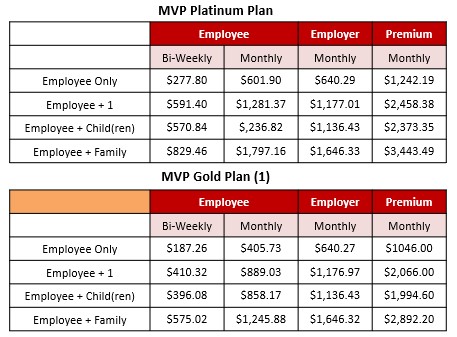

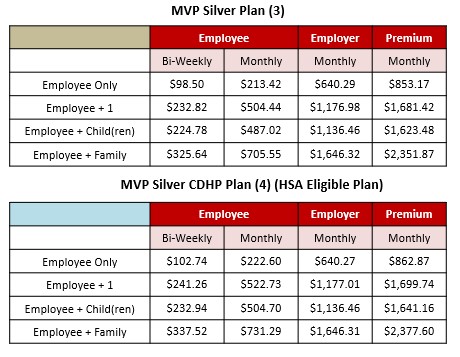

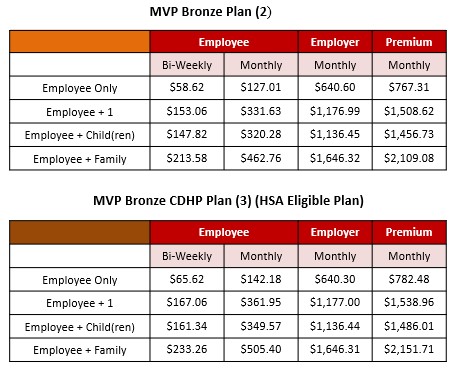

For 2026, employees are offered six plan options through MVP Healthcare.

Eligibility:

Employees who work at least thirty (30) hours per week are eligible for medical coverage on the first of the month following 30 days.

MVP HealthCare

If you enroll in a High Deductible plan, you are eligible to open a Health Savings Account and have pre-tax dollars withheld for use all medical expenses related to your plan as well as other HSA Eligible Expenses.

Click below to see Eligible HSA Expenses.

Forms and Plan Documents

MVP Healthcare

Customer Service: 800-825-5687

Make sure you choose the MVP Preferred PPO as your MVP Plan Type

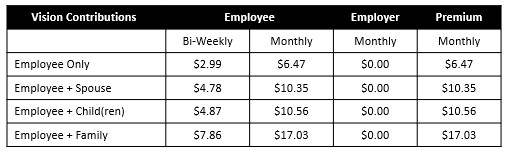

Contributions

MVP Formulary from CVS Caremark 2026

The 2026 MVP Marketplace formulary is managed by CVS Caremark and can be found on the MVP Health Care website. Employees can check if a specific drug is covered by logging into their member account or by reviewing the formulary document available on the MVP website.

- Log in or create an account on the MVP Health Care portal.

- Select “My Plan,” then “My Benefits” to find your Pharmacy “Plan Year” start date and locate your plan’s specific formulary.

GIA is available through MVP Healthcare. Members will need to download the app at my.mvphealthcare.com. GIA connects members to urgent and emergency care in minutes. Look for GIA by MVP in the App Store or scan the QR code!

Download the Gia by MVP mobile app:

Scan the QR code or

Text the word GIA to 898687 (TXTMVP). (Message and data rates may apply.)

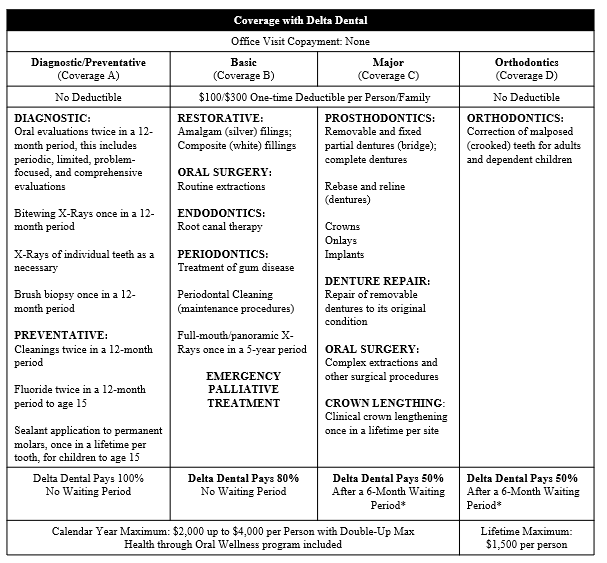

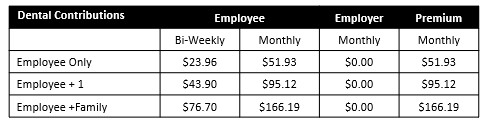

Employees are offered a comprehensive dental benefit insurance plan through Northeast Delta Dental. Under this plan, insureds have the freedom to choose any licensed dentist for their preventative, basic, major and orthodontic dental care, but will only experience full reimbursement by using Delta network providers.

Eligibility

Employees who work at least thirty (30) hours per week are eligible for coverage on the first of the month following 30 days.

Coverage

Contributions

Forms and Plan Documents

Flyers

Group Life & Accidental Death & Dismemberment (AD&D) Insurance is provided to all eligible employees. The death benefit is $50,000. If you are part of Whitney Blake Management Company please reach out to Human Resources.

Eligibility

Employees who work at least thirty (30) hours per week are eligible for coverage on the first of the month following 30 days.

Contributions

This is 100% employer paid.

Eligible employees may elect Voluntary Term Life on themselves, their spouse and/or child(ren)

- Eligibility is first of the month following 30 days of employment for employees scheduled to work 30 or more hours per week.

- Elected amounts must be chosen in increments of $10,000 up to a maximum of $300,000

- You may elect up to $100,000 with no Evidence of Insurability under age 70 and up to $10,000 if over 70 years of age.

- Spouse benefit up to $100,000.

- Child benefit up to $10,000.

Eligibility

Employees who work at least thirty (30) hours per week are eligible for coverage on the first of the month following 30 days.

Contributions

Voluntary life insurance premiums are 100% employee paid. Please refer to the voluntary benefits summary for contribution information.

If an employee is unable to work for an extended period due to a covered accident or illness, Short-Term Disability benefits become payable after an eight-day elimination period.

- Weekly Payment: The benefit provides a weekly payment equal to 60% of the employee’s weekly pay.

- Maximum Benefit: Payments are capped at a maximum of $1,000 per week.

- Benefit Duration: Payments will continue until the employee is able to return to work or a maximum of 26 weeks has lapsed, whichever occurs first

If you are part of Whitney Blake Management Company, please contact Human Resources.

Eligibility

Employees who work at least thirty (30) hours per week are eligible for coverage on the first of the month following 30 days.

Contributions

This is 100% employer paid

After an employee has been continuously disabled and out of work for 180 days, they may be eligible for long-term disability benefits.

- Monthly Payment: The benefit provides a monthly payment equal to 60% of the employee’s monthly pay.

- Maximum Benefit: Payments are capped at a maximum of $4,000 per month.

- Benefit Duration: Payments will continue until the employee can return to work or, if permanently disabled, until they reach age 65, whichever occurs first

If you work for Whitney Blake Management Company please contact Human Resources.

Eligibility

Employees who work at least thirty (30) hours per week are eligible for coverage on the first of the month following 30 days.

Contributions

The Long-Term Disability premiums are 100% employer paid.

Pet Insurance:

Members may purchase voluntary pet insurance coverage on dogs, cats, avian, and exotic pets. Discounts are given for insuring more than one pet per owner. Team members opting for this coverage will be required to complete paperwork to provide directly to the insurer.

**Rates vary based on the covered pets.

Why Choose Nationwide Pet Insurance?

- The most comprehensive pet insurance coverage available as a voluntary benefit

- Choose the level of coverage that fits your needs

- Get 70% or 50% reimbursement on vet bills and more

- No age restrictions

- No lifetime limits

Contributions

This is 100% employee paid.

How to enroll

The first question many pet parents ask is, “How do I sign up for my pet insurance benefit?” There are three easy ways for employees to enroll in a Nationwide pet insurance policy:

- Go directly to the dedicated URL we’ve created for your company: https://partnersolutions.nationwide.com/pet/whitneyblake

- Call 877-738-7874 and mention that they’re employees of Whitney Blake Company to receive employee pricing.

- Or, scan the QR code below and enter your company name.

Pet Insurance – Coverage for your furry & feathered family members!

Employee Landing Page

https://partnersolutions.nationwide.com/pet/whitneyblake

Flyers

EAP is a voluntary, confidential service that provides professional counseling and referral services designed to help with personal, job or family related problems. It is provided by Principal as an add-on benefit to your disability coverage

EAP consultants are available 24 hours a day, 7 days a week, 365 days a year. Any services provided by the EAP counselors are at no charge to you or your family members.

In addition to phone-based help, a lot of information can be found online, such as self-assessment tools, health and wellness calculators, webinars and podcasts.

Whether it’s a simple question, a sudden emergency, or an ongoing problem, you can call EAP. The trained professional staff will help. With just one phone call, at any hour of the day or night, you can reach a compassionate ear and connect to helpful resources.

Licenses professionals provide confidential support and guidance related to:

- Family, relationship and parenting issues

- Basic child and elder care needs

- Emotional and stress-related issues

- Conflicts at work or home

- Alcohol and drug dependencies

- Personal development and general wellness issues

- They can also refer you for in-person counseling

Contributions

This is 100% employer paid.

Whether you’re traveling for business or personal reasons, Reliance’s worldwide emergency travel assistance program through On Call International follows you, whether you travel to a foreign country or just 100 or more miles from home. Some services available are: hospital admission assistance, critical care monitoring and care of minor children just to name a few. Please read the brochure below for more information.

Eligibility

Employees who work at least thirty (30) hours per week are eligible for coverage on the first of the month following 30 days.

Contributions

Reliance Standard provides many other services employees receive along with their Life and Disability benefits. You don’t have to do anything special to qualify for these services–just work for Whitney Blake!

Eligibility

Employees who work at least thirty (30) hours per week are eligible for medical coverage on the first of the month following 30 days.

Contributions

This is 100% employer paid.

Whitney Blake Company offers a Voluntary Accident Plan through Reliance Standard.

This coverage provides a range of fixed, lump-sum benefits for injuries resulting from a covered accident, or for accidental death and dismemberment. The coverage includes initial care and emergency care, hospitalization, fractures, dislocations and follow up care. The benefits are paid directly to the insured and may be used for any purpose (healthcare or otherwise).

There is a Health Screen Test Benefit, examples include but not limited to mammography and blood tests. This benefit is paid once a year to the covered individual for $50. The dollars may be used for any purpose (healthcare or otherwise). The payment will come in form of a check addressed to the covered individual.

Eligibility

Employees who work at least thirty (30) hours per week are eligible for coverage on the first of the month following 30 days.

Contributions

This is 100% employee paid.

Whitney Blake Company offers a Voluntary Critical Illness Plan through Reliance Standard.

This coverage provides a range of lump-sum benefits based on your initial benefit amount for critical illness conditions covered. The coverage includes cancer, vascular, nervous system and other specified conditions. For a full list of conditions and lump-sum payments covered visit your Employee Benefit Center. The benefits are paid directly to the insured and may be used for any purpose (healthcare or otherwise).

There is a Health Screen Test Benefit, examples include but not limited to mammography and blood tests. This benefit is paid once a year to the covered individual for $50. The dollars may be used for any purpose (healthcare or otherwise). The payment will come in form of a check addressed to the covered individual.

Eligibility

Employees who work at least thirty (30) hours per week are eligible for coverage on the first of the month following 30 days.

Contributions

This is 100% employee paid.

Retirement Plan

Welcome to the Whitney Blake Company Retirement Plan! This is a resource for all your retirement needs and questions. Please review the information below and contact Mike LaRoss (mlaross@wblake.com), (802) 463-9558 x1112) with any questions or comments.

We have organized this website with the following information:

- General Information:

- Includes information on what a 401(k) Plan is and why you should consider participating. Because business retirement plans are tailored by each individual employer, we have also provided you with a summary of our plan’s unique details.

- How to Join the Plan:

- Enrollment should be done online through T. Rowe Price’s online enrollment module (T. Rowe Price Enrollment website.) Click on “Register” in the top right-hand side to get started. For questions specific to navigating the online enrollment module, contact T. Rowe Price directly at (800) 354-2351.

- How to Access/Manage Your Account Online:

- All transactions should be done through your online account (distributions, loans, contribution changes, rollovers, etc.). If you cannot access your account online, you may call T. Rowe Price directly to initiate transactions at (800) 354-2351.

General Information

Click here to read the Complete Enrollment Guide on the benefits of contributing towards your retirement and a guide on how to:

- determine your contribution

- what type of contribution (Roth or pre-tax)

- which funds to invest in

- how to rollover funds

- much, much more

How to Join the Plan

If you are not currently enrolled in the plan but would like to be, you may follow one of these simple, user-friendly options listed below. Click here to read more about your options.

- Enroll by phone with T. Rowe Price: call 1-800-354-2351.

- Go online to rps.troweprice.com and click “Enable Online Access”.

- Try using the mobile app at troweprice.com/mobilesolutions.

- Download an enrollment form from this site and return via instructions listed on the form.

Access Your Account Online

Simply click on the following website: rps.troweprice.com. First-time visitors will have to set up a username and password. If you enrolled online, you would have set this up during enrollment. Through this link you will have the following at the click of a button:

- Risk analysis tools to help you determine what investments you may want to choose.

- Retirement calculator tools to help you determine how much money you need to save for retirement and how much you should be contributing to get there.

- Access to previous account statements, your current account balance, fund research, ability to change your investments, change your savings rate, update your beneficiary and so much more.

Contact our Plan’s Retirement Plan Consultants:

Steve Burnett & Allie Lambert

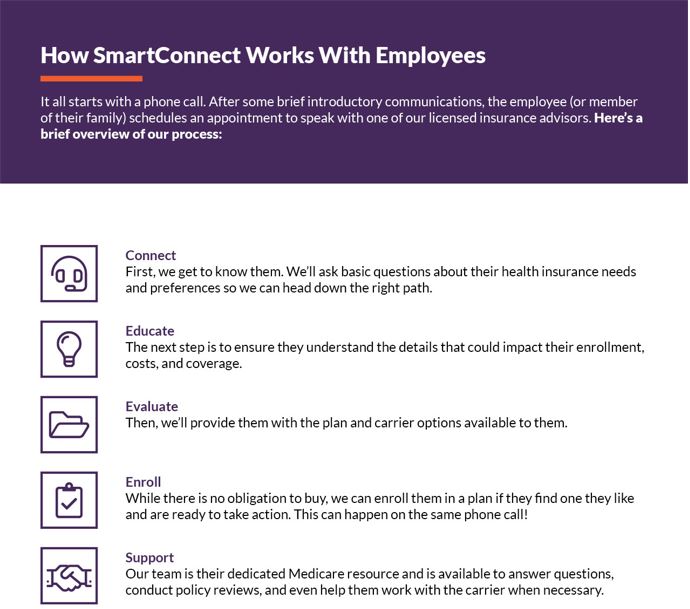

SmartConnect – Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information:

(833)502-2747 TTY: 711

For more information or to get started, please click on the following link:

Additional Information